How is mainframe usage changing — and what does that tell us?

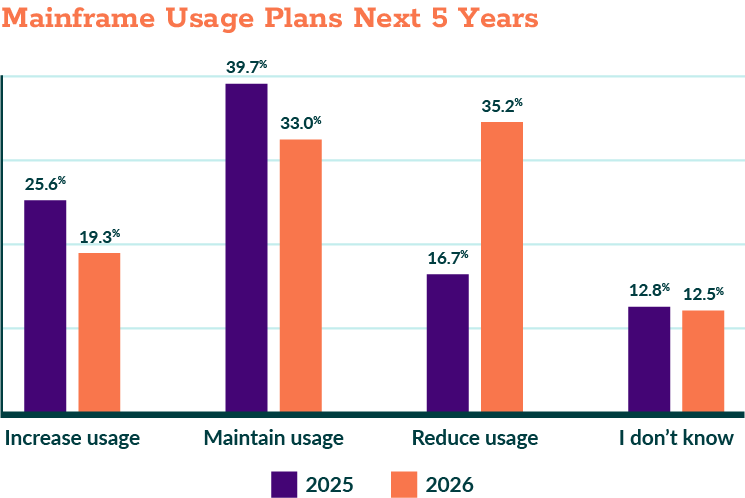

Across the 2026 survey, respondents report moderate growth or stable mainframe usage, with a smaller group indicating declines. Several forward-looking questions were introduced in 2025 to enhance longitudinal tracking; together, the 2025 and 2026 results establish an initial directional baseline.

Large-scale contraction remains uncommon. Reported changes are incremental rather than abrupt, suggesting that mainframe capacity decisions are shaped by long planning horizons and business demand, rather than short-term technology cycles.

Figure 4.1: Direction of Mainframe Usage Change (2025–2026)

Question: How do you expect mainframe usage in your organization to change over the next five years?

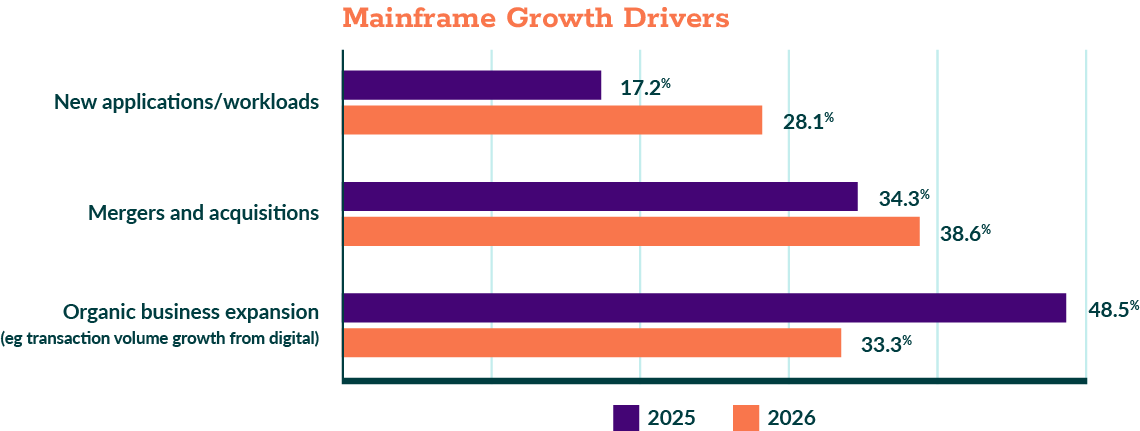

Growth Reflects New Demand

Among organizations reporting growth, the primary drivers are consistent with prior surveys: business expansion, new applications, and workload consolidation. Growth is driven by new or expanded demand, not by inertia.

Figure 4.2: Primary Drivers of Mainframe Usage Growth (2025–2026)

Question: What is driving the growth in mainframe capacity and usage in your organization?

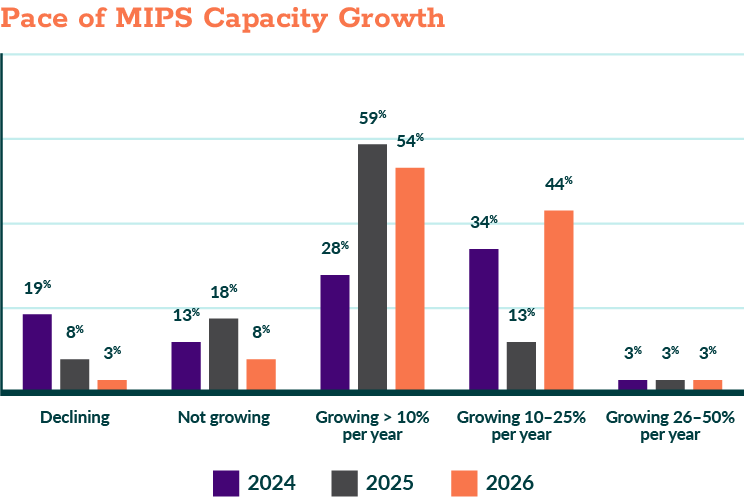

Stability as Managed Equilibrium

Stable usage remains one of the most common responses. Growth bands were refined beginning in 2025 to better distinguish low and moderate expansion, so year-over-year movement across categories should be interpreted directionally rather than as exact shifts.

Even with that adjustment, the overall pattern remains consistent. Capacity holds steady, not because change is absent, but because growth and reduction pressures are balanced.

Figure 4.3: Stable Mainframe Usage Reported by Respondents (2026)

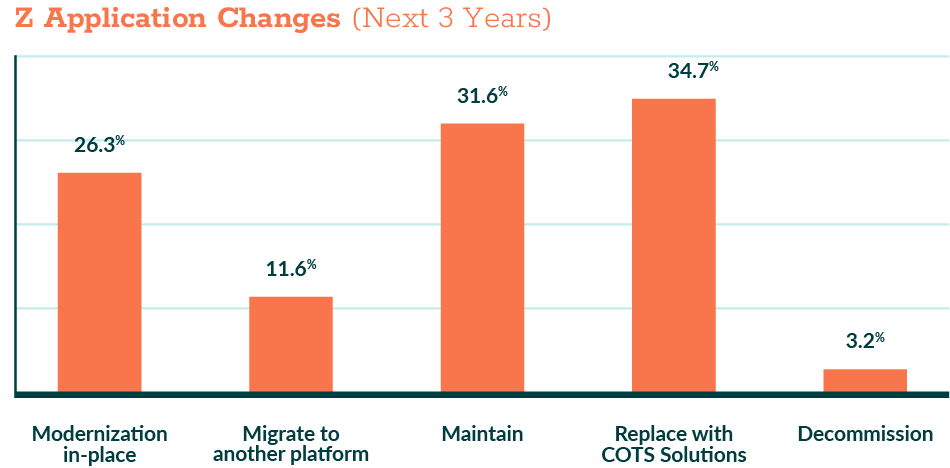

Declining Mainframe Use is Minimal

A smaller group of respondents report declining mainframe usage in 2026. Where declines are reported, they do not typically signal platform exit. Instead, they reflect selective workload adjustments, with core transaction processing and system-of-record functions remaining on the mainframe.

Looking ahead three years, respondents indicate a mix of maintenance, modernization, and targeted replacement strategies for core IBM Z applications. Maintenance (31.6%) and replacement with COTS solutions (34.7%) represent the largest categories, while migration to another platform (11.6%) and decommissioning (3.2%) remain comparatively limited. Taken together, the data suggest portfolio refinement rather than broad platform withdrawal.

Figure 4.4: Z Application Changes (Next 3 Years)

Question: What do you expect to happen to your core applications on IBM Z over the next three years?

0 Comments